Let’s be real—sometimes life hits you with expenses you didn’t see coming. Whether it’s a surprise medical bill, a home Reno that can’t wait, or just needing to consolidate debt,personal loans can be a lifeline. But here’s the thing: not all loans are created equal. Some come with sky-high rates, others with sneaky fine print. This guide? It’s your no-BS breakdown of how personal loans actually work. The good, the bad, and the “hell no’s”—so you can borrow smarter, not harder.

What Is a Personal Loans?

Alright, let’s talk **personal loans**—because sometimes life hits you with a surprise expense (thanks, universe).

In simple terms, a personal loans is money you borrow from a bank, credit union, or online lender. You get it all at once, then pay it back in monthly chunks over a set time (usually 2 to 7 years). Oh, and of course, there’s interest—because nothing’s ever actuallY free.

Unlike credit cards (which are like financial quicksand if you’re not careful), personal loans have fixed payments. That means no nasty surprises—your bill stays the same every month. Nice, right?

But here’s the catch: Your credit score matters. A lot. The better your credit, the lower your interest rate. Bad credit? You might still get approved, but you’ll pay more for it.

People use **personal loans** for all kinds of stuff—consolidating debt, home repairs, even funding a wedding (no, eloping isn’t always cheaper). Just remember: It’s not free cash. Borrow smart, pay on time, and don’t let it turn into a financial headache.

How Personal Loans Work (Spoiler: It’s Not Free Money)

Let’s get this straight—**personal loans** aren’t some magical cash fountain. You’re basically borrowing from your future self (with interest). Here’s how it *actually* works:

1) You apply and cross your fingers

2) If approved, you get a lump sum dumped into your account

3) You start paying it back monthly like clockwork

The kicker? That low rate they advertised? Only the luckiest borrowers actually get it. Everyone else pays more. That’s why reading the fine print isn’t optional—it’s survival. Check it.

Secured vs. Unsecured Loans: What’s the Difference?

With **personal loans**, you’ve got two flavors:

– *Secured:* You put up collateral (like your car or savings). Lower rates, but, you know… riskier.

– *Unsecured:* No collateral needed. Higher rates, but nothing gets repossessed if you default.

Most **personal loans** are unsecured, which is great until you see the interest rate. Pro tip: If you’ve got assets to secure it, you’ll save big on interest.

Common Uses for Personal Loans (Beyond “I Need Cash ASAP”)

Sure, **personal loans** can bail you out of emergencies, but the smartest uses?

✔️ Debt consolidation (bye-bye, 22% credit card interest).

✔️ Home improvements that actually add value.

✔️ Medical bills (because health insurance is its own tragedy).

✔️ Even starting a small business (if you’ve got a solid plan).

Just remember: Taking a loan to fund a vacation or shopping spree is how smart people do dumb things with money. The best **personal loans** solve problems – they don’t create new ones.

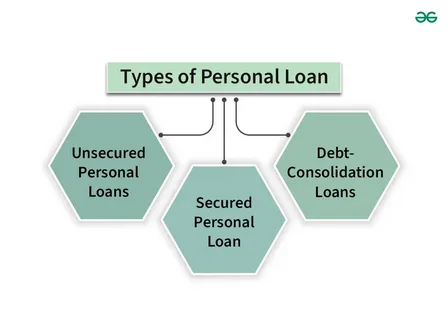

Types of Personal Loans

Debt Consolidation Loans (Merge Debts & Save Money)

Let’s be real—juggling multiple payments with sky-high interest rates is exhausting. That’s where **personal loans** for debt consolidation come in clutch. Instead of paying 20%+ on credit cards, you:

• Roll everything into one loan (hello, single payment)

• Typically score a lower interest rate

• Actually see an end date to your debt

Just don’t make the rookie mistake—you have to cut up those credit cards after, or you’ll wind up right back in debt.

Debt Consolidation Loans (Merge Debts & Save Money)

Let’s be real—juggling multiple credit card payments is like trying to keep a dozen plates spinning. One wrong move and CRASH – late fees, sky-high

interest, and your credit score takes a hit. That’s where **personal loans** for debt consolidation come in clutch.

Here’s the play:

– You get one loan to pay off all those nagging balances

– Suddenly you’ve got just ONE payment to track each month

– Bonus? You’ll likely score a lower interest rate than what your cards are charging

Pro tip: Don’t just consolidate and then run up the cards again (we’ve all been tempted). Cut ’em up or freeze ’em in a block of ice if you have to. The goal is to actually get out of debt, not just rearrange it.

Home Improvement Loans (Renovate Without Draining Savings)

That “dream kitchen” ain’t gonna build itself, but dropping $30k from your savings? Oof. A home improvement **personal loans** lets you spread the cost over time so you’re not eating ramen for a year.

Good for:

✔️ Kitchen/bath remodels (goodbye, avocado green appliances)

✔️ Adding that home office you desperately need

✔️ Emergency repairs (because water heaters love dying at 3 AM)

Medical Loans (When Health Bills Hit Hard)

Medical debt is the worst kind of surprise. **Personal loans** for healthcare costs can be smarter than

✔️ Maxing out credit cards

✔️ Draining your 401(k)

✔️ Ignoring bills until collections call

Wedding Loans (Say “I Do” Now, Pay Later)

Let’s face it—weddings are stupidly expensive. The average couple drops $30K+ on one day (yikes). If your savings account isn’t cutting it, **Personal Loans** can help cover costs without maxing out credit cards. Just remember: that open bar might feel worth it now, but you’ll still be paying for it later. Budget wisely, lovebirds.

Vacation Loans (YOLO, But Wisely)

Need a getaway, but your bank account says, “lol no”? can fund that dream trip—just don’t go full *Eat Pray Love* with debt. Pro tip: Skip loans for luxury resorts (bad ROI) and use them for *experiences* (like that bucket-list safari). Because memories > interest payments, but only if you’re smart about it.

Credit-Builder Loans (For When Your Credit Sucks)

Got a credit score lower than your GPA in freshman year? **Personal Loans** designed to *build* credit (not wreck it) exist. You “borrow” a small amount, pay it back on time, and boom—your credit gets a glow-up. It’s like training wheels for adulting. Just don’t miss payments, or you’ll undo all the work.

Bottom line: **Personal Loans** can be tools or traps—it’s all about how you use them. Borrow like your future self will thank you, not curse you. 💸✨

Just watch out for predatory lenders targeting desperate patients. Legit **personal loans** have clear terms – not “pay us forever” fine print.

Remember: All these **personal loans** work best when they solve a problem, not create new ones. Borrow smart, pay on time, and actually read the terms. Your future self will thank you.

Personal Loans Interest Rates: The Real Deal

Let’s talk about the elephant in the room—**interest rates**. They’re the reason “borrowing $10,000” can turn into “paying back $13,000” if you’re not careful. But don’t stress—we’ll break it down so you don’t get played.

Fixed vs. Variable Rates (Which One Won’t Screw You?)

Picking between fixed and variable rates is like choosing between a steady relationship and a wild fling—both have their perks, but one’s way riskier.

✅ Fixed Rates

– Your rate stays the same for the entire loan term.

– Predictable payments = no nasty surprises.

– Best if you hate financial drama (or just hate math).

⚠️ Variable Rates

– Starts lower (tempting, right?) but can climb over time.

– Great if you plan to pay off the loan fast before rates jump.

– Risky if the economy goes haywire (looking at you, inflation).

Bottom line? If you’re the “set it and forget it” type, go fixed. If you’re a gambler with a solid exit plan, maybe consider variable.

What’s a “Good” Interest Rate? (Spoiler: It Depends)

Ah, the million-dollar question. A “good” rate isn’t one-size-fits-all—it depends on your credit score, the lender, and whether you’ve recently sacrificed a goat to the credit gods.

🔹 For Excellent Credit (720+):

– You’re golden. Rates as low as 6-10%. Lenders basically roll out the red carpet.

🔹 Good Credit (650-719):

– Not bad! Expect 10-15%. Could be worse—like payday-loan worse.

🔹 Fair/Poor Credit (Below 650):

– Brace yourself. Rates can hit 18-36% (yikes). Might be worth fixing your credit first.

Pro Tip: Always compare rates from at least 3 lenders. And if a rate seems too good to be true? It probably is.

How Your Credit Score Affects Rates (The Brutal Truth)

Let’s keep it real—your personal loans Interest rate? It’s basically a popularity contest, and your credit score is the judge. The higher your score, the sweeter the deal. Got bad credit? Lenders hit you with those high-risk rates (aka “we don’t trust you” tax). A 700+ score gets you the VIP treatment; under 600? Brace for APRs that’ll make your eyes water.

Pro tip: Even a **small score bump** (like paying off a credit card) can save you hundreds. Check your score *before* applying—no surprises.

Hidden Fees to Watch Out For (Don’t Skip This Part)

Sure, that **personal loans** looks shiny with its low rate… until the fine print bites you. Here’s the sneaky stuff lenders *hope* you ignore:

Origination fee (they take a cut *before* you even get the cash—rude).

Prepayment penalties (because *paying early* somehow hurts their feelings).

Late payment fees (Miss a due date? That’ll be $15-$40, thanks.

Pro tip? Always read the fine print. If a lender won’t clearly explain fees, walk away. Your wallet will thank you later.

Final thought? Personal Loans can be great—but only if you’re not getting played. Know your score, watch for fees, and borrow like you actually want to keep your money. 💸🔍

How to Qualify for a Personal Loans

Alright, let’s cut to the chase—getting a **personal loan** isn’t like winning the lottery. Lenders actually want to know you’ll pay them back (shocking, right?). Here’s the real deal on what it takes to get that “approved” stamp.

Credit Score Requirements (The Magic Number)

Your credit score is basically your financial GPA, and lenders are the strict professors grading your paper. Here’s how they break it down:

🔹 **750+ (The Ivy League):** You’re getting the red carpet treatment with the lowest rates

🔹 **700-749 (Honor Roll):** Still getting good deals, just maybe not the absolute best

🔹 **650-699 (Passing Grade):** You’ll qualify, but rates won’t be anything to brag about

🔹 **Below 650 (Summer School):** It’s going to be tougher, but some lenders specialize in “second chance” loans

Fun fact: That “pre-approved” offer in your mailbox? It’s not a guarantee—they still check your actual score when you apply. Bummer, I know.

Income & Employment Rules (Prove You Can Pay It Back)

Lenders aren’t just being nosy about your job—they’re trying to figure out if you’re good for the money. Here’s what they’re really looking for:

✅ The Gold Standard:

– Steady job for 6+ months (no, your side hustle selling vintage socks doesn’t count)

– Regular paychecks that show up like clockwork

– Enough leftover after bills to actually make loan payments

🚩 Red Flags That Make Lenders Nervous:

– Just started a new job last week (even if it’s your dream gig)

– Income that jumps around like a caffeinated kangaroo

– More than half your paycheck already going to debt payments

Pro tip: If you’re self-employed, you’ll need tax returns or bank statements to prove you actually make money. “Trust me, bro” doesn’t work here.

Debt-to-Income Ratio: Your Financial Report Card

Here’s the dirty little secret about personal loans: lenders don’t just care how much you make; they care how much you *owe*. Your debt-to-income ratio (DTI) is like a financial stress test:

• *Under 35%* = “This one’s responsible” (lenders love you).

• *36-49%* = “We can work with this” (but rates might be higher).

• *50%+* = “Yikes, let’s talk after you pay some bills down.”

Calculate yours:

[All monthly debt payments] ÷ [Gross monthly income] = DTI

Pro tip: That “buy now, pay later” sofa payment counts as debt. So do your student loans. Basically, if you owe it regularly, it’s working against you.

How to Get Approved (Even If Your Credit’s Seen Better Days)

Got less-than-stellar credit? Don’t panic. You can still score a **personal loans** if you:

✔️ *Add a co-signer* – Find someone with good credit willing to vouch for you

✔️ *Offer collateral* – Secured loans are easier to get (but riskier for you)

✔️ *Shop credit unions—they’re more flexible than big banks

✔️ *Lower your ask* – Requesting $5k instead of $10k increases approval odds

✔️ *Explain your situation* – A letter about past financial hardships can help

Remember: Every “no” gets you closer to a “yes.” And those prequalification tools? Use them—they don’t hurt your credit.

The Bottom Line

Getting a **personal loans** comes down to showing lenders three things:

1. You pay your bills on time (credit score)

2. You’ve got money coming in (income)

3. You’re not drowning in other debts (DTI ratio)

No perfect credit? No six-figure salary? Don’t sweat it—there are options out there. You might just need to shop around a bit more or accept slightly higher rates.

Remember: Every “no” gets you closer to a “yes.” And hey, if all else fails, there’s always that vintage sock business to fall back on. (Just kidding… mostly.)

Got denied before? What was your experience? Spill the tea in the comments—we’re all learning here. ☕

How to Apply for a Personals Loan Without the Stress

Getting a **Personal Loans** doesn’t have to feel like filing taxes. Here’s the no-BS breakdown of where to go, what you’ll need, and how to actually get approved.

Where to Get a Personal Loans (Banks, Credit Unions, or Online?)

Not all lenders are created equal. Here’s the scoop:

Big Banks (Chase, Wells Fargo, etc.)

Pros: Trusted names, sometimes lower rates if you’re already a customer.

Cons: Strict requirements, slow approval.

Credit Unions

Pros: Lower rates, more flexible with iffy credit.

Cons: You have to join one first (but it’s usually cheap).

– **Online Lenders (SoFi, Upstart, LendingClub)**

– *Pros:* Fast approval, often easier on credit scores.

– *Cons:* Higher rates if your credit’s not great.

**Best move?** Compare at least 3 options. A 5-minute rate check could save you thousands.

Documents You’ll Need (No One Likes Last-Minute Panic)

Don’t be that person scrambling last second. Have these ready:

ID: Driver’s license or passport.

Proof of income: Pay stubs, tax returns, or bank statements.

Employment info: Boss’s contact, job history.

Debt details: List of what you owe (credit cards, other loans).

Pro tip: If self-employed, grab 6+ months of bank statements. Lenders get twitchy about “unstable” income.

The Application Process (From Click to Cash)

1. **Pre-qualify first** (soft credit check—no score ding).

2. **Pick your loan terms** (amount, repayment length).

3. **Submit docs** (usually upload online).

4. **Wait for approval** (could be minutes or days).

5. **Get funded** (cash hits your account in 1-7 days).

Warning: Watch for sneaky fees before signing. If the APR jumps at the last step, walk away.

What to Do If You’re Denied (Plan B Tactics)

Rejected? Don’t freak. Try this:

1. **Ask why** (lenders must tell you—sometimes it’s an easy fix).

2. **Apply with a co-signer** (mom, dad, that friend with 800 credit).

3. **Lower the amount** (asking for $3K instead of $10K helps).

4. **Try a credit union** (they say “yes” when banks say “no”).

5. **Wait 3-6 months** (pay down debt, fix errors on your credit report).

Last resort: Secured **Personal Loans** (backed by your car/savings). Riskier, but gets you cash.

Final thought? **Personal Loans** can be a lifeline—if you borrow smart. Shop around, read the fine print, and *never* take the first offer. Your wallet will thank you later. 💸🔍

Personal Loans Alternatives (Because Options Are Good)

So a personal loan isn’t your only move when you need cash. Depending on your situation, one of these might work better—or save you some serious dough. Just know the pros and cons before jumping in.

Credit Cards (When Swiping Beats Borrowing)

Good if: You need smaller amounts or short-term flexibility.

0% APR cards: Score one with a promo period, and you’re basically getting an interest-free **Personal Loans** (if you pay it off in time).

Rewards: Get cash back or points while you spend.

BUT… Miss a payment or carry a balance past the promo? Congrats, you’re now paying 25% interest. Ouch.

Best for: One-time expenses you can pay off fast.

Home Equity Loans (If You Own a Home)

Good if: You need a big chunk of cash and have equity.

Lower rates than **Personal Loans** (because your house is collateral).

Tax-deductible interest (sometimes—check with your accountant).

BUT… Your home is on the line. Default = goodbye house.

Best for: Major reno or debt consolidation—if you’re *super* sure you can repay.

Payday Loans (Just… Don’t.)

Good” if: You enjoy financial self-destruction.

The math: A $500 payday loan can cost you $575 in two weeks. That’s a 400%+ APR.

Cycle of doom: Most borrowers roll them over 10+ times.

Alternatives: Pawn shops, side gigs, or even begging your boss for an advance are all better ideas.

Best for: Literally no one. Run.

Borrowing from Friends/Family (Risky, But Sometimes Works)

Good if: You *really* trust each other (and never want to speak again).

Pros: No credit check, no interest (if you’re lucky).

Cons: Awkwardness, ruined relationships, and “remember that $2K you owe me?” at Thanksgiving.

Fix: Write a real agreement with terms. Or just… don’t.

Best for: Emergencies only—and only if you’re 100% sure you’ll repay.

Final thought: **Personal Loans** are great, but not the only option. Weigh the pros/cons—and please skip the payday loans. Your future self will high-five you. 🙌💸

FAQs About Personal Loans (Real People Questions)

Can I Pay Off a Personal Loans Early?

Hell yes, you can—and often should! But check for:

• Prepayment penalties (some lenders charge for paying too fast—rude, we know)

• Whether your interest is front-loaded (less benefit to early payoff)

Most **personal loans** actually reward early repayment. Just confirm you’re not getting punished for being responsible.

How Long Does Approval Take?

Depends on where you shop:

✔️ Online lenders: As fast as 1 hour (same-day funding possible)

✔️ Credit unions/banks: 1-5 business days (they move like molasses)

✔️ Peer-to-peer: 3-7 days (waiting on random people to fund you)

Pro tip: Having all your docs ready cuts approval time in half.

Do Personal Loans Hurt Your Credit?

Short answer: Temporarily, then helps. Here’s the breakdown:

– Hard inquiry at application: Small ding (5-10 points)

– New account: Minor dip

– Consistent payments: Builds credit over time

The sweet spot? Using a **personal loan** to pay off credit cards lowers your utilization = credit score boost. Just don’t max the cards out again.

Q: Can I Get One With Bad Credit?

Technically yes, but…

• Rates will hurt your feelings

• Loan amounts will be smaller

• Some lenders specialize in bad credit **personal loans**

Better option? Get a co-signer or work on your credit first. Your wallet will thank you later.

Remember: No dumb questions when it comes to borrowing money. Well, except “Should I take a payday loan?” The answer’s always no.